Browsing The Small Print - Terms And Conditions Of No Credit Scores Inspect Financings

Produced By-Herrera Bowles

Throughout tough economic times, like the COVID-19 pandemic or past due bills, it can be alluring to get a short-term lending. Yet it is essential to carefully examine your requirements, compare lenders, and completely understand the car loan terms prior to obtaining any kind of type of finance.

please click the up coming website page can be useful in specific situations, but they carry high rates of interest and can result in a cycle of financial obligation if not managed responsibly.

What is the Fine Print?

The fine print is message or information that is not as plainly presented in a document such as an agreement. Fine print might be included for a number of reasons, including to consist of lawfully binding arrangements in agreements and to reveal auxiliary information that is not useful to include in larger message.

The legislation needs that small print should be plainly noticeable and understandable. Nonetheless, that does not constantly occur. For example, bank card business are infamous for hiding fees, interest rates and repayment terms in the small print of their agreements. This indicates that lots of people that take out finances with high-interest rates do not totally recognize the terms and conditions of their finance. This can bring about expensive repercussions that can affect your credit score negatively. You should constantly read the fine print very carefully. This consists of the terms and conditions of a no credit history check lending. It is likewise a good idea to think about options to no-credit-check lendings.

Exemptions

The small print is very important to check out since it has the terms that govern your connection with an organization. This details might not be as attractive as the headlines, however it's vital to understand prior to buying or becoming part of a contract with a company.

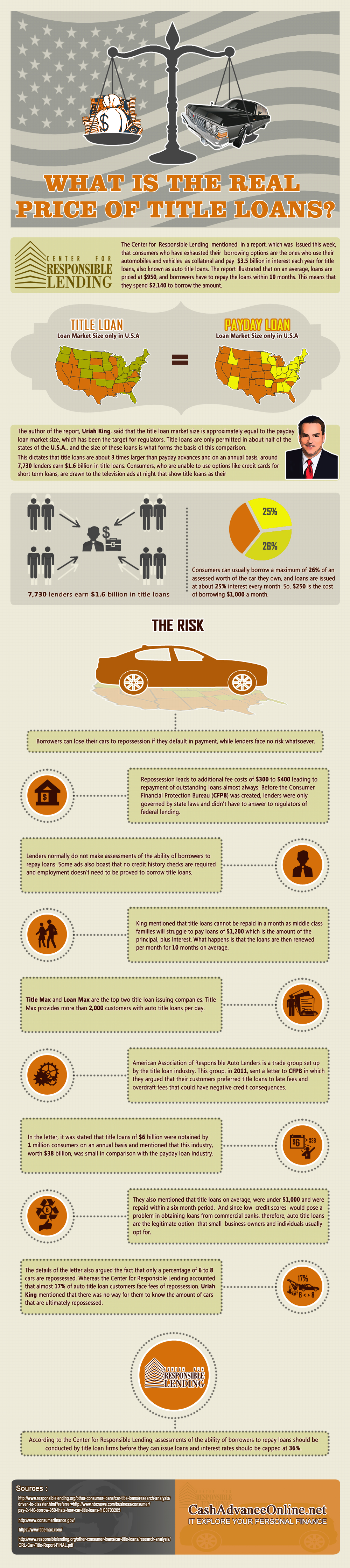

For instance, some no credit report check finances are cash advance or vehicle title car loans with expensive rates of interest. These high payments can place you right into a cycle of financial obligation and can even result in unfavorable repercussions to your credit report. Additionally, most no credit history check lenders do not report repayment info to the credit history bureaus.

To avoid these problems, you can opt for an individual funding with a lending institution that carries out a soft credit report check. A soft credit history check is an extra detailed means to establish your capacity to pay back, which can aid you avoid obtaining greater than you can pay for and getting stuck in a cycle of financial debt.

get more info of interest

In order to help you prevent falling into a financial obligation trap, financing laws and guidelines set minimal requirements for lenders. Some states restrict the rates of interest that loan providers can charge on a no credit rating check lending, and others call for a loan provider to examine your capability to repay the loan by evaluating checking account information, doing a soft credit report pull or checking different credit report bureaus.

Still, numerous no credit scores check lendings are extremely costly and must be utilized just as a last resort funding choice. Payday and automobile title fundings, for instance, are recognized for having extremely brief settlement terms (commonly just 1 to 4 weeks) and high monthly costs that often cost you greater than the initial amount of cash obtained. These car loans likewise don't construct your debt and can cause a vicious circle of financial obligation. To assist avoid this, it is very important to recognize your credit score report and file any type of wrong info on your report with the credit scores bureau.

Charges

The fine print in agreements and contracts usually has fees that are hidden from borrowers. Making the effort to assess these terms is important to avoid falling into a debt cycle that can cause additional charges, financial challenge and unexpected costs.

The sort of finance you pick will influence just how much you pay in the long run. For instance, cash advance normally have short repayment terms and are made for riskier consumers, so they tend to have high interest rate.

If you are considering a no credit check car loan, it is necessary to very carefully analyze your monetary scenario, vigilantly compare lending institutions and totally recognize the regards to the funding prior to applying. You need to also try to find lending institutions that examine your capability to pay off by assessing your bank account, doing a soft credit score pull or examining different data sources. This will certainly assist you avoid a loan that is hard to pay off, which can result in costly over-limits and late costs.